wyoming tax rate for corporations

There is also a limit to how many shareholders the. If there have not been any rate changes then the most recently dated rate chart reflects the rates currently in effect.

Ey On Tax Parity The S Corporation Association

So your initial costs.

. 1000 or so to talk to your CPA. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your. This bill in both past and current versions has been sold as a way to bring money.

A Wyoming LLC also has to file an annual report with the secretary of state. Cheyenne WY 82002-0110. The annual report fee is based on assets located in Wyoming.

Wyoming Department of Revenue. Wyoming Department of Revenue Website. Herschler Building 2nd Floor West.

Tax rate charts are only updated as changes in rates occur. On top of that rate counties in Wyoming collect local sales taxes of up to 2. Wyoming Internet Filing System WYIFS The.

39-15-105 a viii O which exempts sales of tangible personal property or services. The 2022 state personal income tax brackets. Corporate rates which most often are flat regardless of the amount of income.

327 to have us form the Wyoming LLC for you. Ad Compare Your 2022 Tax Bracket vs. The state sales tax in Wyoming is 4 tied for the second-lowest rate of any state with a sales tax.

Form your Wyoming LLC with simplicity privacy low fees asset protection. Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. Select Popular Legal Forms Packages of Any Category.

Wyomings license fee amounts to 0002 for every dollar of in-state. This fee is 60 or two-tenths of one million on the dollar 0002 of all in-state. Up to 25 cash back Tax rates for both corporate income and personal income vary widely among states.

The tax is either 60 minimum or 0002 per dollar of. All Major Categories Covered. 1000 or so to talk to your local lawyer.

Wyoming does not have an individual income tax. Registering for Wyoming Business Taxes Online. Wyoming does not have an individual income tax.

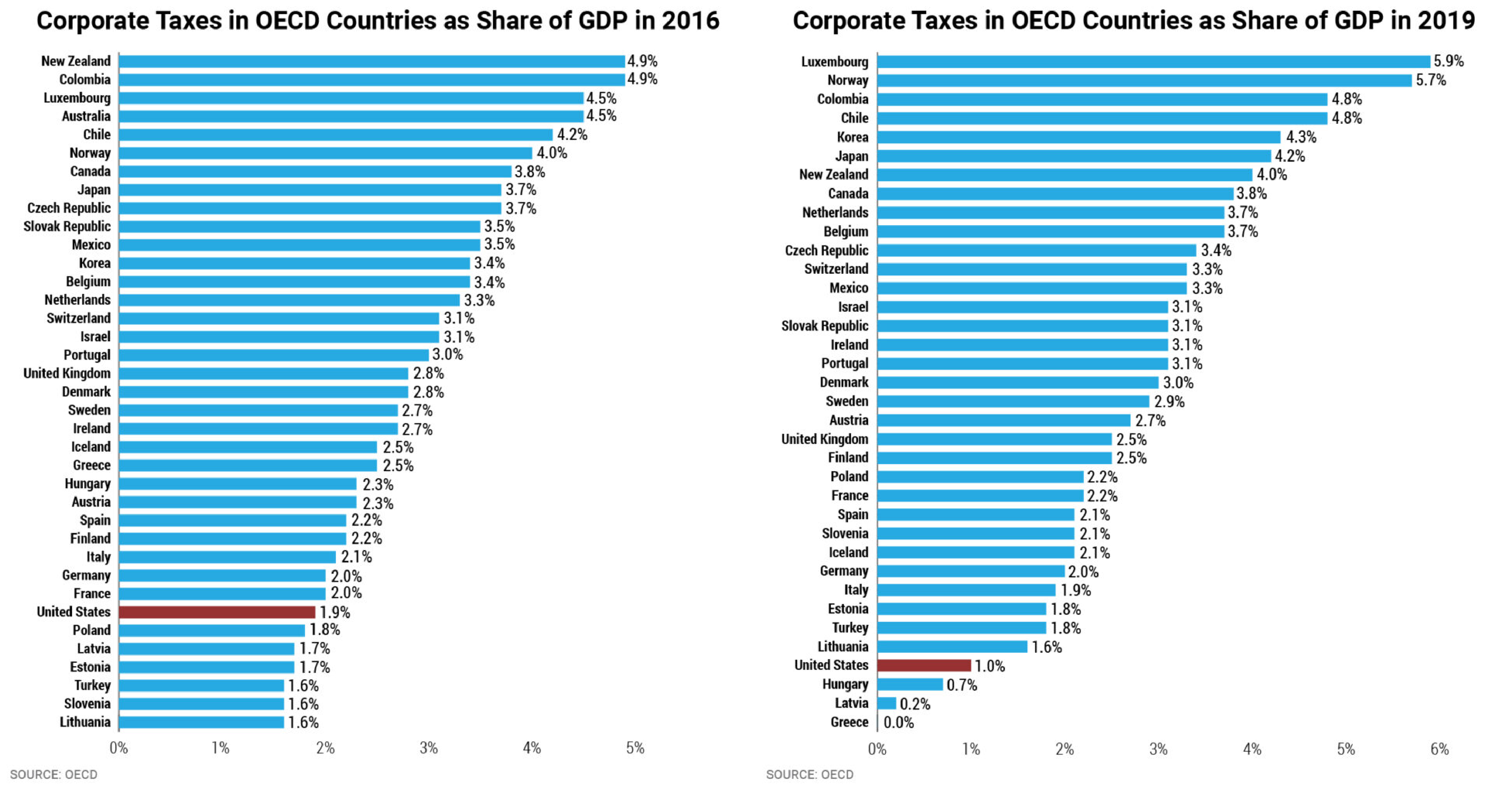

This fee is levied against the in-state assets of limited partnerships LLCs and corporations doing business in the state. The tax credits would also reduce the effective corporate tax rate of those paying any of the taxes listed above. Your 2021 Tax Bracket to See Whats Been Adjusted.

Wyoming also does not have a corporate income tax. Performed for the repair assembly alteration or improvement of railroad rolling. Wyoming also does not have a corporate income tax.

Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. Find out what tax credits you might qualify for and other tax savings opportunities. Wyomings proposed corporate income tax only falls on a few select industry sectors at least initially but its a foot in the door for a broader corporate taxsomething.

Wyoming corporations and Wyoming LLCs are required to pay a fee each year when filing their annual report. Wyomings license fee amounts to 0002 for every dollar of in-state. Discover Helpful Information and Resources on Taxes From AARP.

Ad Bank Account included with our 199 LLC formation. Get a quote from. Before the official 2022 Wyoming income tax rates are released provisional 2022 tax rates are based on Wyomings 2021 income tax brackets.

Form your Wyoming LLC with simplicity privacy low fees asset protection. S-Corporations are different from C-Corporations in that S-Corporations do not have to deal with double taxation and only file taxes annually. Wyoming Department of Revenue.

Ad Free small business tax consultation tailored to your state and industry. Ad Bank Account included with our 199 LLC formation. If you use Northwest Registered Agent as your.

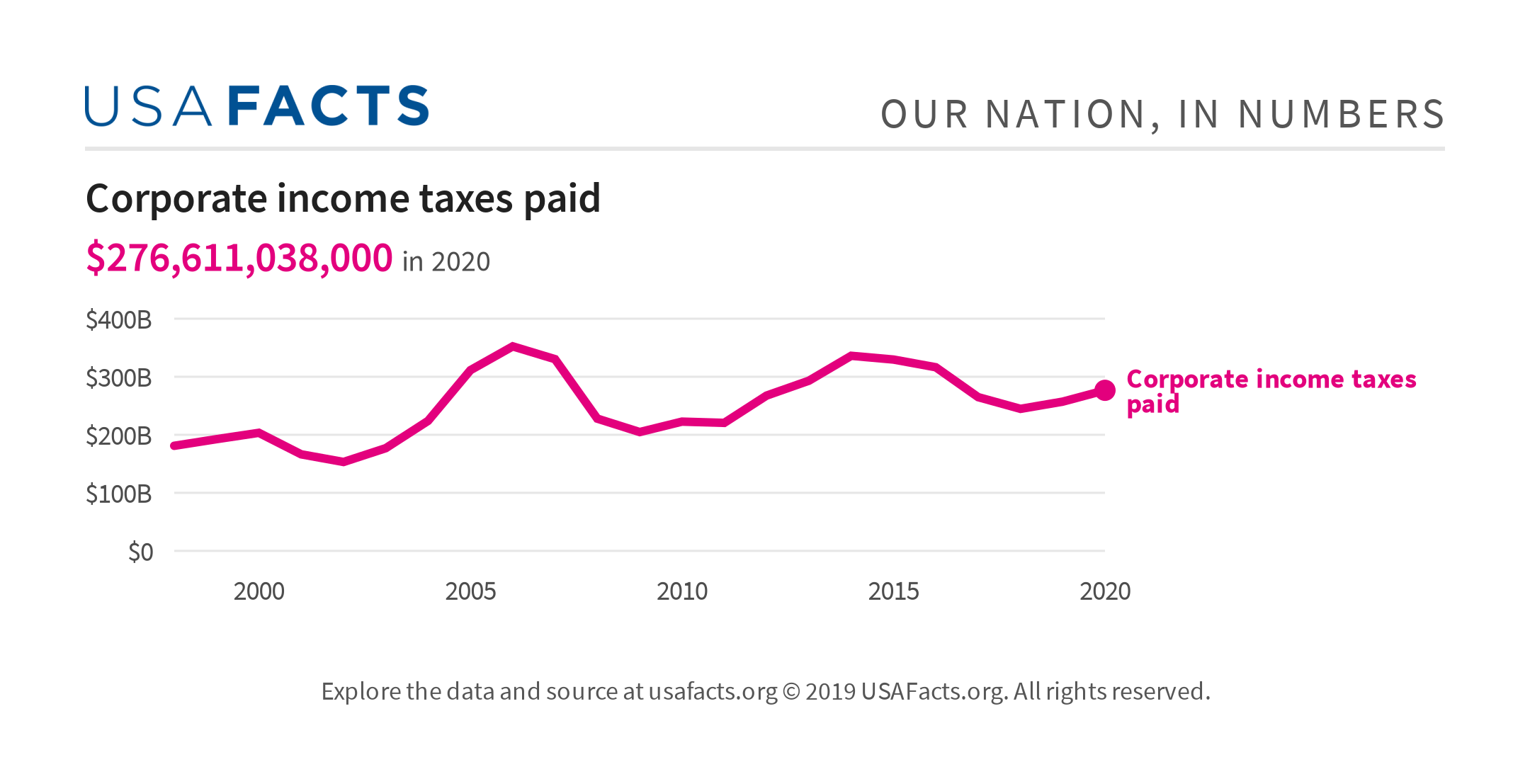

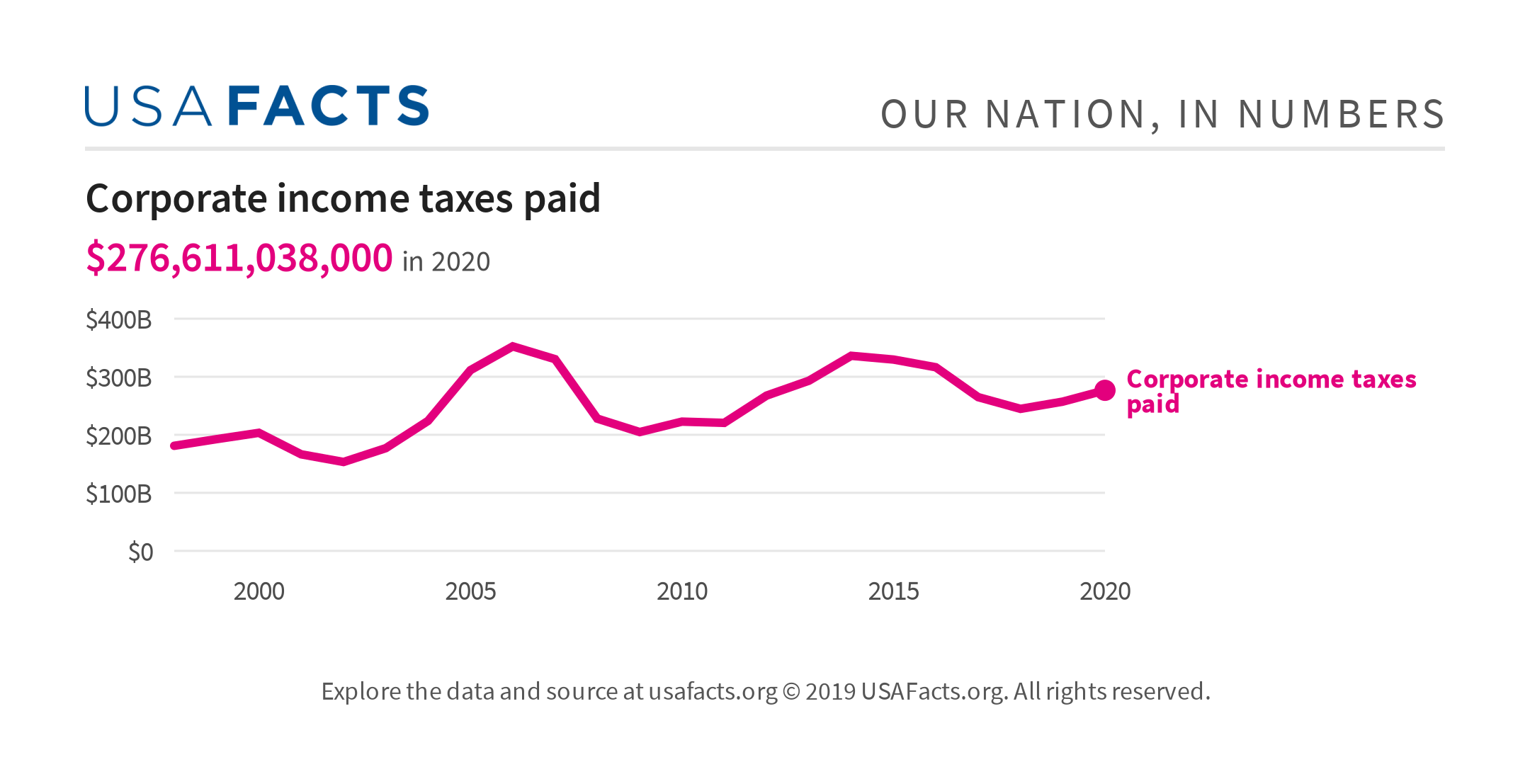

Corporate Income Taxes Paid Usafacts

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

:max_bytes(150000):strip_icc()/ScreenShot2021-02-09at9.53.37AM-3b9683fcfe1641f7a2a84cd4efa92474.png)

Form 1120 S U S Income Tax Return For An S Corporation Definition

Corporate Taxes By State In 2022 Balancing Everything

Corporate Taxes By State Where Should You Start A Business Hourly Inc

How Do State And Local Corporate Income Taxes Work Tax Policy Center

How To Choose A Unique Business Name Infographic Unique Business Names Business Names Business Infographic

Which State Has The Highest Corporate Income Tax Rate Accountingweb

State Income Taxes Increase Burden On Corporate Profits Taxops

Why Congress Should Reform The Federal Corporate Income Tax Itep

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Corporate Tax Rates By State Where To Start A Business

Uber Drivers Airbnb Hosts Get Tax Tips As Irs Launches New Web Page On Shared Economy Airbnb Host Economy Sharing Economy

Corporate Taxes By State In 2022 Balancing Everything

Lawmakers Voted Down A Corporate Income Tax Cut This Spring Leadership Should Leave It Out Of The Budget Oklahoma Policy Institute

Corporate Taxes By State In 2022 Balancing Everything

Oregon S Business Taxes Tied For Lowest In The Nation Oregon Center For Public Policy